Invopop, what is Cabify's former co-founder doing with the new e-invoicing regulation?

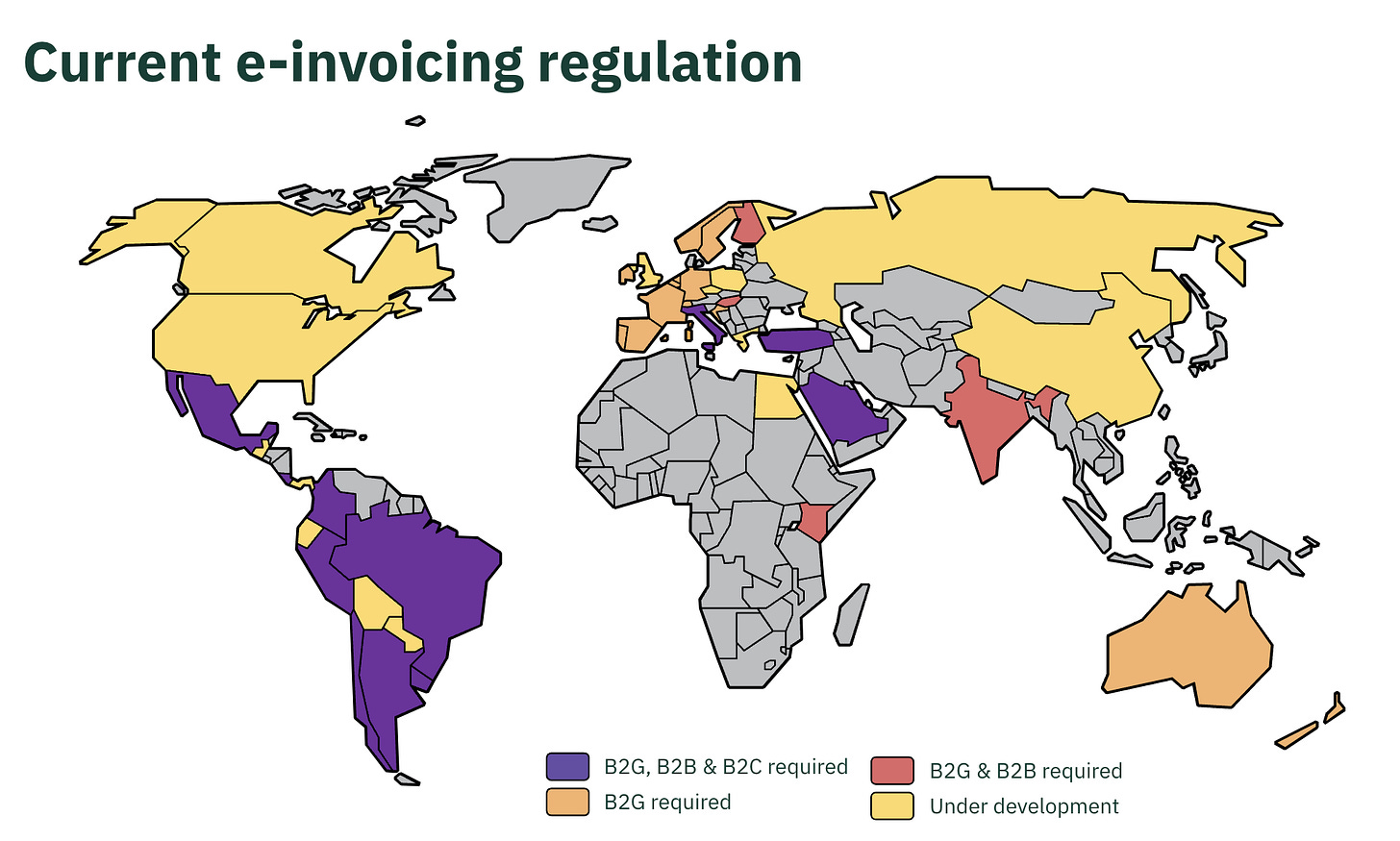

Invopop automates e-invoicing processes following the new international regulation, by offering easy integration and regulatory compliance for enterprises.

In the today’s edition of How to land in Venture Capital, I want to give you an investment memo, typically an analysis that a VC conducts on a startup to determine whether they should invest in a specific company or not.

Today’s deep dive: Invopop, the most promising electronic-invoicing startup out there…

But first, are you looking for a Venture Capitalist role in Europe?

European VC Job Openings (2 out of 9)

Asset Partners is hiring a Venture Capital Associate / Senior Associate

Location: London, United Kingdom

https://www.linkedin.com/jobs/view/3939048999/Future Energy Ventures is hiring a VC Investment Analyst

Location: Berlin, Germany

https://join.com/companies/fev/11794885-investment-analyst-with-finance-background-all-genders

What is the former CTO and co-founder of Cabify doing within the new e-invoicing regulation?

Let’s start with the structure of this post. First, an overview of the startup, afterwards (for the paid subscribers) all the European VC Job Openings of the last week, and lastly, the investment memo and my personal opinion about investing or not.

Structure of this Post

Today’s company: overview of the company analyzed + one-pager

Brief overview of the Investment Memo in simple terms.

European VC Job Openings

Investment Memo

Team

Market Opportunity & Size

Problem

Solution

Customer and Business Model

Competition

Traction and/or Metrics

Would I invest?

Today’s company: Invopop

Invopop is a FinTech startup that automates electronic invoicing globally, ensuring compliance with local tax regulations through a single API. The platform simplifies the process of issuing e-invoices in various formats required by different countries' tax authorities.

🔎 Company name: Invopop

📈 Stage: Pre-seed/Seed

💵 Valuation: Undisclosed

✍️ Year Founded: 2020

👔 Employees: 6

📈 Business Status: Generating Revenue

📊 Milestones: achieved initial PRODUCT-MARKET-FIT + customer VALIDATION

📚 Other: SOLID founding team

Please note that we also have Investment Memo’s of other companies on our website: Genesy AI, Distinkt and Bioo.

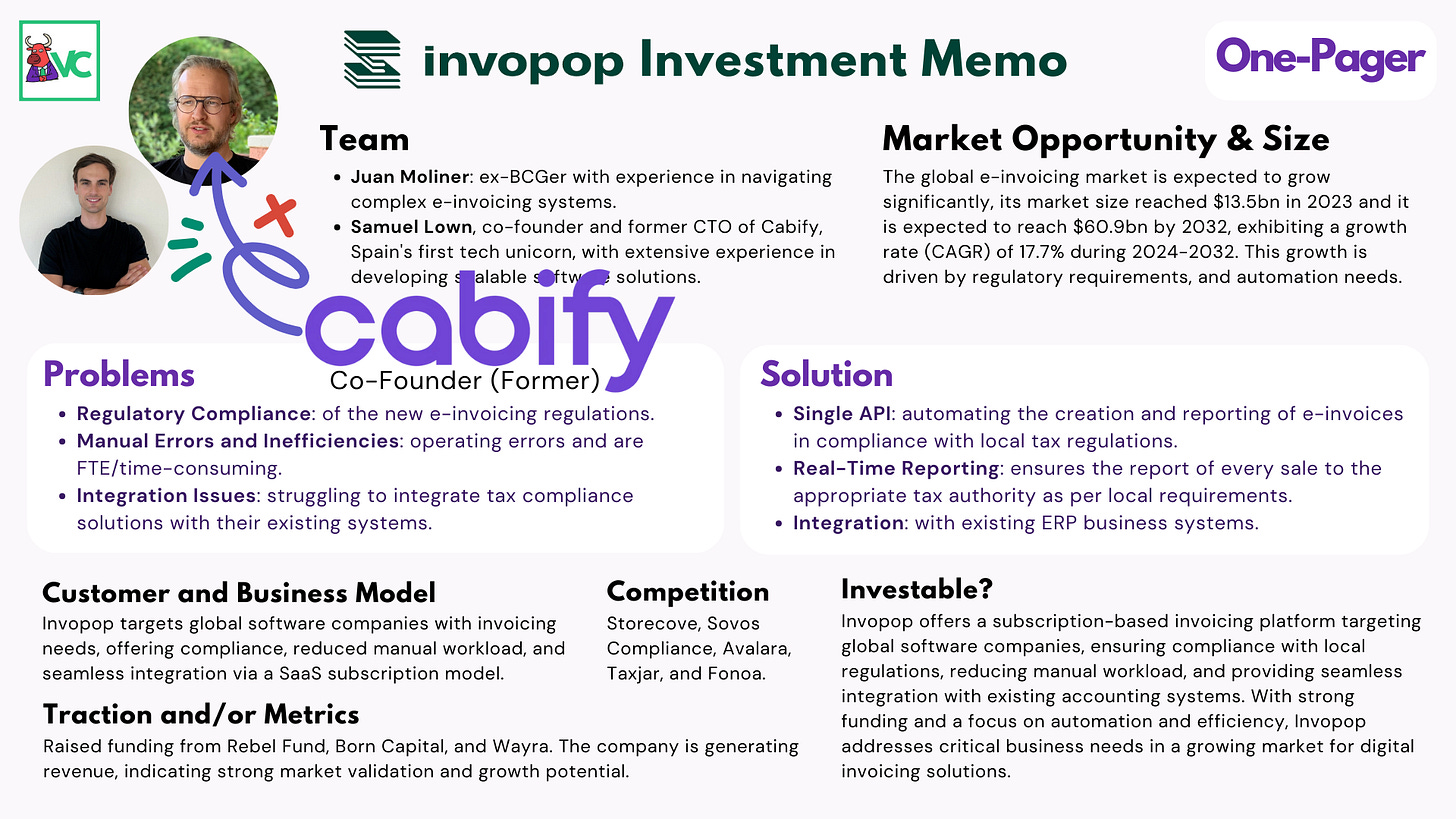

One-pager

Here’s a one-pager with the essentials of Invopop:

(Click on the picture to expand)

And remember, if you want to start doing your own investment memo’s for your analysis, here you can find the post on how to analyze startups:

European VC Job Openings (9 out of 9)

Keep reading with a 7-day free trial

Subscribe to How to land in Venture Capital to keep reading this post and get 7 days of free access to the full post archives.