How to build a Cap Table? Hands-on exercise and a template to create yours for Aspiring VC Investors and Startup CEOs

Welcome to the #14 edition of How to land in Venture Capital: a weekly newsletter of valuable pieces of research to help you land a job in VC, and some of the best VC Dealflow startup analysis.

An increasing number of you are going paid, thanks!! I’m happy to have you here!

In the today’s edition of How to land in Venture Capital, I want to share to you the valuable insights on a crucial aspect of the VC landscape: the creation and management of a Cap Table. This essential tool tracks the equity distribution of a startup, providing clarity on ownership stakes and helping to manage future funding rounds effectively.

Today’s deep dive: How to create a Cap Table? Hands-on exercise and template for Aspiring VC Investors and Startup CEOs

A Cap Table is more than just a document—it's a strategic asset for any startup. It provides a clear picture of ownership and helps in making informed decisions regarding equity distribution and fundraising. By understanding the basics, key components, and maintaining accuracy, founders can better navigate the complexities of startup financing and growth.

Let’s start with the definition. After that, the key components, terms and finally a Complete Exercise.

Structure of this Post

What is a Cap Table?

A capitalization table, or cap table, is a spreadsheet showing ownership stakes in a company.

Key Components of a Cap Table (basic and advanced ones):

Founders’ shares, investor equity, stock options, convertible notes, SAFE, preferred shares, anti-dilution provisions, and warrants.

Common Terms and Definitions

Pre-money valuation, post-money valuation, common shares, preferred shares, options, convertible notes, SAFE, outstanding ownership, fully diluted ownership.

A Complete Exercise + Google Sheet template to do it by yourself

Hands-on Cap Table exercise with detailed instructions and a Google Sheet template to practice/build it.

In this episode of How to land in Venture Capital, we will see the most important things about Cap Tables, spotted in some VC interviews. Subscribe for more:

What is a Cap Table?

A cap table lists all the securities (shares, options, warrants, etc.) that a company has issued and who owns them. It's used to track ownership stakes, manage equity, and plan for fundraising.

Cap tables are vital for founders, investors, and legal advisors to understand the company's capital structure.

Key Components of a Cap Table

The basic ones:

Founders' Equity: represents the shares allocated to the founders when the company is first established. It is crucial for reflecting the initial ownership split and setting the stage for future ownership dilution.

Investor Shares: include shares allocated to external investors during funding rounds. Different types of shares (common vs. preferred) can exist, each with its own set of rights and privileges.

The more advanced ones:

Employee Stock Options (ESOP): are shares reserved for employees as part of their compensation package. They are used to attract and retain talent by providing a financial incentive tied to the company's success.

Convertible Securities: are instruments like convertible notes and Simple Agreements for Future Equity (SAFEs) convert into equity upon certain triggering events, such as future financing rounds.

Venture debt and loans: financing that involves borrowing funds with the promise to repay with interest, often accompanied by warrants.

Warrants: an instrument that give holders the right to purchase additional shares at a predetermined price, often used as sweeteners in financing deals.

Down rounds and anti-dilution provisions: financing rounds at lower valuations than previous rounds and protections for early investors to prevent their ownership from being diluted.

Participating preferred stock with caps: preferred stock that receives investment back plus a portion of remaining proceeds, capped at a specific amount.

Flow of Funds analysis: a detailed financial analysis of various exit scenarios, including circular calculations for employees’ option exercises.

Common Terms and Definitions

Pre-money valuation: company’s value before the latest funding round.

Post-money valuation: company’s value after the latest funding round.

Common Stocks: standard shares usually held by founders and employees.

Preferred Stocks: shares held by investors with priority over common stocks.

Options: right to buy shares at a set price, often part of employee compensation.

Convertible Notes: debt that converts to equity upon reaching a specific milestone.

SAFE: investment promising future equity, without maturity or interest.

Outstanding Ownership: percentage ownership of issued stocks, excluding unissued options.

Fully Diluted Ownership: percentage ownership including all security types, issued and unissued.

Now, in order to understand properly the Cap Table,

The Complete Cap Table Exercise you need to understand a Cap Table, but first, all the VC job opening of the past week:

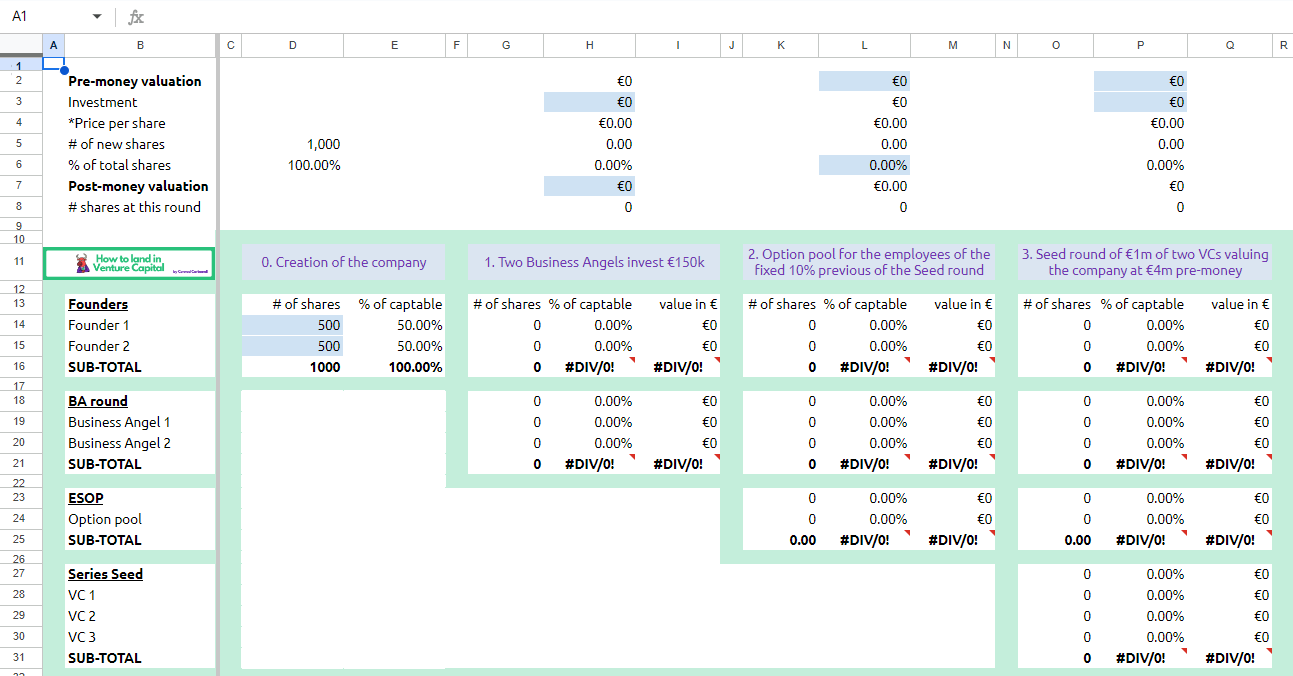

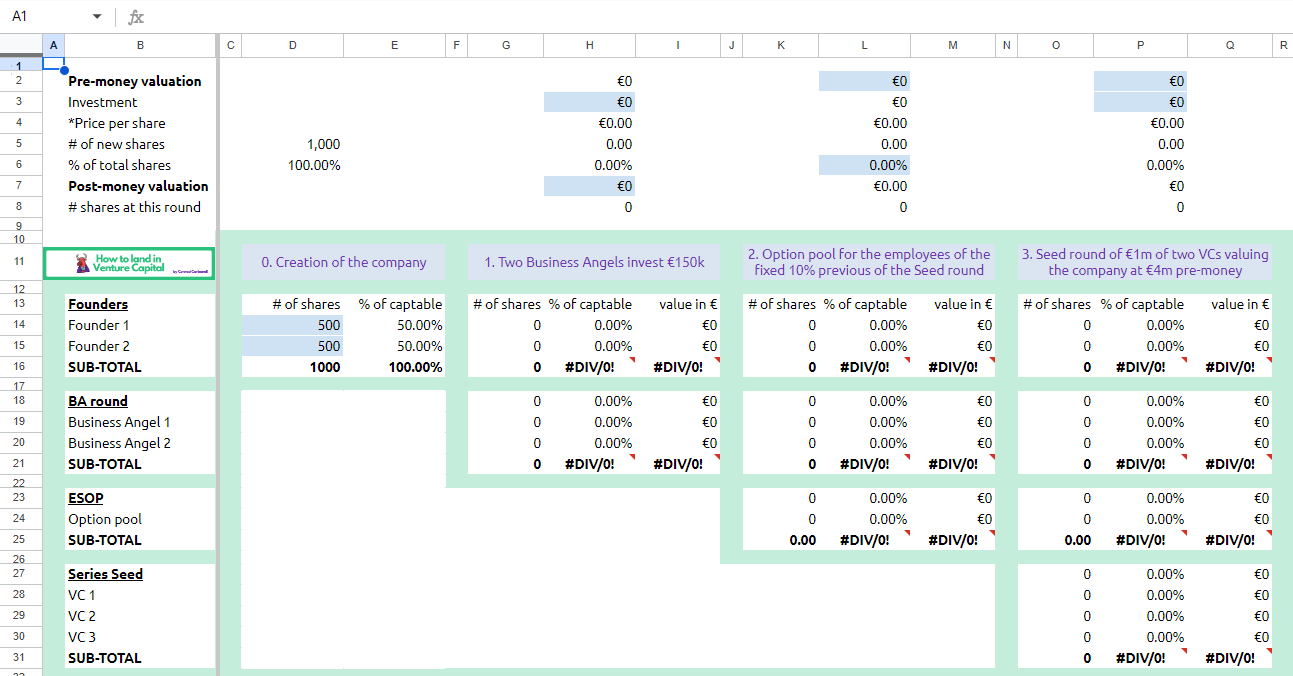

Cap Table Exercise

Creating a capitalization table is an essential skill for any VC investor. A cap table helps you track ownership stakes, valuations, and the impact of investment rounds on the equity distribution.

This exercise will guide you through the process of creating a cap table step-by-step, using a hypothetical scenario involving founders, a business angel, an employee stock option pool (ESOP), and venture capitalists. By the end of this exercise, you will understand how to calculate pre- and post-money valuations, issue new shares, and adjust ownership percentages.

Instructions

Cap Table Template: use this sheet to familiarize yourself with the format and structure of a cap table. Practice adding new rounds of funding and adjusting ownership percentages.

Cap Table Exercise (Empty): follow the scenario and step-by-step instructions to fill in the cap table. Calculate the pre- and post-money valuations, issue shares to new investors, and adjust the ownership percentages accordingly.

Cap Table Exercise (Solution): refer to this completed example to check your work and ensure you have correctly followed the steps.

Scenario

Founders: each founder holds 500 shares, totaling 1,000 shares (50% each).

Business Angel Investment: a business angel invests €150,000 at a €1,000,000 post-money valuation.

ESOP (Employee Stock Option Pool): an option pool is established at 10% of the pre-round valuation.

Venture Capital Investment: three venture capitalists invest a total of €1,000,000 at a €4,000,000 pre-money valuation.

Step-by-Step Solution

Step 1: Initial Ownership

Founders: each founder starts with 500 shares.

Total Shares: 1,000 shares.

Ownership: each founder owns 50% of the company.

Step 2: Business Angel Investment

Pre-money valuation: €850,000.

Investment: €150,000.

Post-money valuation: €1,000,000 (Pre-money valuation + Investment).

New Shares Issued: 176.47 shares (Investment / Price per share).

Price per Share: €850 (€850,000 / 1,000 shares).

Total Shares After Investment: 1,176.47 shares.

Ownership Breakdown:

Founders: 1,000 shares (85.00%).

Business Angel: 176.47 shares (15.00%).

Step 3: Establish ESOP

ESOP: 10% of the total shares before the seed round.

Pre-round Total Shares: 1,176.47 shares.

ESOP Shares: 130.72 shares (10% of 1,176.47 shares).

Ownership Breakdown:

Founders: 1,000 shares (76.50%).

Business Angel: 176.47 shares (13.50%).

ESOP: 130.72 shares (10.00%).

Step 4: Venture Capital Investment

Pre-money valuation: €4,000,000.

Investment: €1,000,000.

Post-money valuation: €5,000,000 (Pre-money valuation + Investment).

New Shares Issued: 326.80 shares (Investment / Price per share).

Price per Share: €3,060 (€4,000,000 / 1,307.19 shares).

Total Shares After Investment: 1,634.52 shares.

Ownership Breakdown:

Founders: 1,000 shares (61.20%).

Business Angel: 176.47 shares (10.80%).

ESOP: 130.72 shares (8.00%).

Venture Capitalists: 326.80 shares (20.00%).

Final Ownership Summary

Founders: 1,000 shares, 61.20%, valued at €3,060,000.

Business Angel: 176.47 shares, 10.80%, valued at €540,000.

ESOP: 130.72 shares, 8.00%, valued at €400,000.

Venture Capitalists: 326.80 shares, 20.00%, valued at €1,000,000.

We encourage you to download the provided template and practice creating your own cap table. Stay tuned for upcoming posts in this series, where we will delve deeper into cap table management and advanced concepts.

If you have any doubts on this exercise or you need something specific from me, do not hesitate in texting me.

Hope you get your VC dream job very soon! See you next week.

Disclaimer 1: I am not gaining any financial or other personal benefits from announcing or promoting this startups. My purpose is solely to provide information based on the available data.

Disclaimer 2: the information provided is for informational purposes only and does not constitute investment advice. I encourage readers to conduct their own research and due diligence before making any investment decisions.